Why Californians Affected by Wildfires Should Consider Moving to Puerto Rico

Why Californians Affected by Wildfires Should Consider Relocating to Puerto Rico: A Strategic Move Toward Financial Relief and Stability

California has long been a desirable place to live due to its diverse culture, economic opportunity, and natural beauty. However, in recent years, wildfires have become a persistent and devastating reality for thousands of residents. From loss of property and displacement to increased living and insurance costs, wildfire survivors are facing both emotional and financial trauma.

For those rebuilding their lives, relocating to Puerto Rico may offer not only a fresh start but also significant financial advantages. As a U.S. territory, Puerto Rico provides the security of staying within the American legal and financial system while offering unique tax incentives that can dramatically reduce the tax burden for individuals and businesses. This document explores why wildfire survivors in California should seriously consider moving to Puerto Rico for both financial relief and long-term stability.

The Wildfire and Tax Burden in California

- State Income Tax: Up to 13.3%

- Capital Gains Tax: Combined with federal, can reach up to 37%

- Property Taxes: High due to rising home values

- Cost of Living: Among the highest in the nation

For many wildfire survivors, rebuilding in California means continuing to pay a premium to live in a high-risk zone. This financial pressure can be overwhelming, especially when paired with the costs of recovery and reconstruction.

Puerto Rico as a Financial Refuge

Puerto Rico offers a compelling alternative for U.S. citizens seeking both affordability and tax efficiency. Moving to the island doesn’t require a passport, and residents still have access to most federal benefits. But the real draw lies in Puerto Rico's tax laws, especially under the Puerto Rico Incentives Code (Act 60):

- Individual Investors:

- 0% tax on capital gains accrued after residency

- 0% tax on Puerto Rico-sourced dividends and interest

- Export Services Businesses:

- 4% corporate tax rate

- 100% tax exemption on distributions from Puerto Rican entities

- No Federal Tax: On income sourced from Puerto Rico

A Fresh Start and Long-Term Stability

- Reduced Financial Stress: Thanks to lower taxes and cost of living

- Access to Federal Programs: Including disaster relief and Medicare

- Thriving Expat and Remote Work Community: Especially appealing to entrepreneurs and professionals

- Tropical Climate and Natural Beauty: Without the constant threat of wildfires

Relocation is never an easy decision, but for those who have already lost so much, Puerto Rico offers a safe and promising alternative. With careful planning and consultation with a tax advisor, wildfire survivors can rebuild their lives with greater financial security and peace of mind.

Next Steps

In light of increasing wildfire risk and California’s significant tax burden, relocating to Puerto Rico presents a unique opportunity for survivors to regain control of their financial future. The island’s generous tax incentives under Act 60, combined with its lower cost of living and U.S. jurisdiction, make it an ideal destination for those seeking a new start.

- Consult a Tax Advisor: Ensure you meet the requirements for Puerto Rican tax benefits.

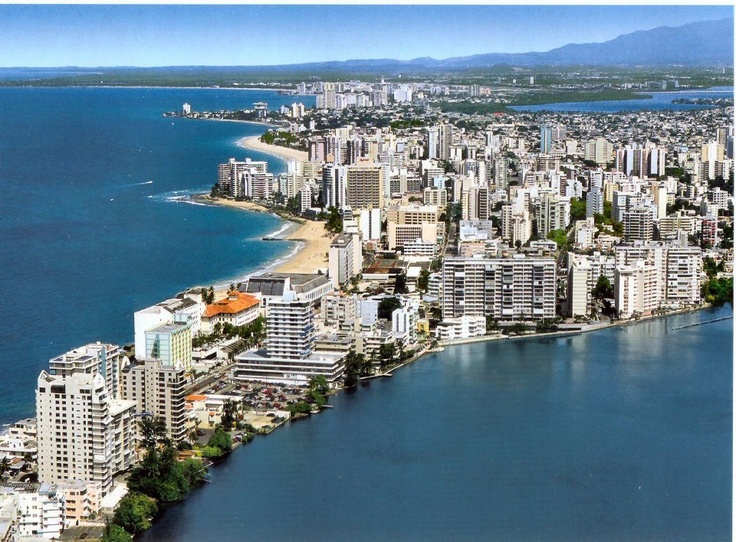

- Visit Puerto Rico: Explore neighborhoods, schools, and lifestyle options.

- Plan Your Move Strategically: Fulfill the bona fide residency tests to qualify for Act 60.

- Connect with the Community: Engage with expat groups and local organizations.

Why Californians Affected by Wildfires Should Consider Moving to Puerto Rico

Wildfires are pushing many Californians to reconsider where they call home. Puerto Rico offers a fresh start — with financial relief, tax incentives, and long-term stability — all within the U.S. system.

California Challenges

- 🌪 Wildfire risk & displacement

- 💰 Up to 13.3% income tax

- 🔥 Soaring housing & insurance costs

- 📈 High cost of living

Puerto Rico Advantages

- ✅ 0% capital gains (Act 60)

- ✅ 4% business tax rate

- ✅ No federal tax on local income

- ✅ Lower housing & living costs

New Life Benefits

- 🌴 No wildfires, tropical paradise

- 🧘♂️ Reduced financial stress

- 💡 Remote work & expat communities

- 📚 Access to U.S. benefits

Take the First Step Toward Stability & Savings

Let us help you find your dream home in Puerto Rico — and rebuild with financial peace of mind. Schedule a consultation today.

📞 Talk to a Relocation ExpertWe at Elite Puerto Rico Reality Can help you find your dream home. CALL US TODAY! Schedule a Trip to Puerto Rico.

We will then show you LUXURY Homes and have you meet with Tax Experts and Law Firms so you can start your Relocation Process!

ALSO . If interested in Florida and USA Mainland instead

Click this Page