Puerto Rico Tax benefits

- Home

- Puerto Rico Tax benefits

We are Your Trusted Partner in Personal & Corporate Tax Exemptions

Thinking about relocating to Puerto Rico? You're in the right place. At Elite Puerto Rico Realty, we specialize in helping individuals and businesses unlock Puerto Rico’s powerful tax incentives—while enjoying the island’s world-class lifestyle.

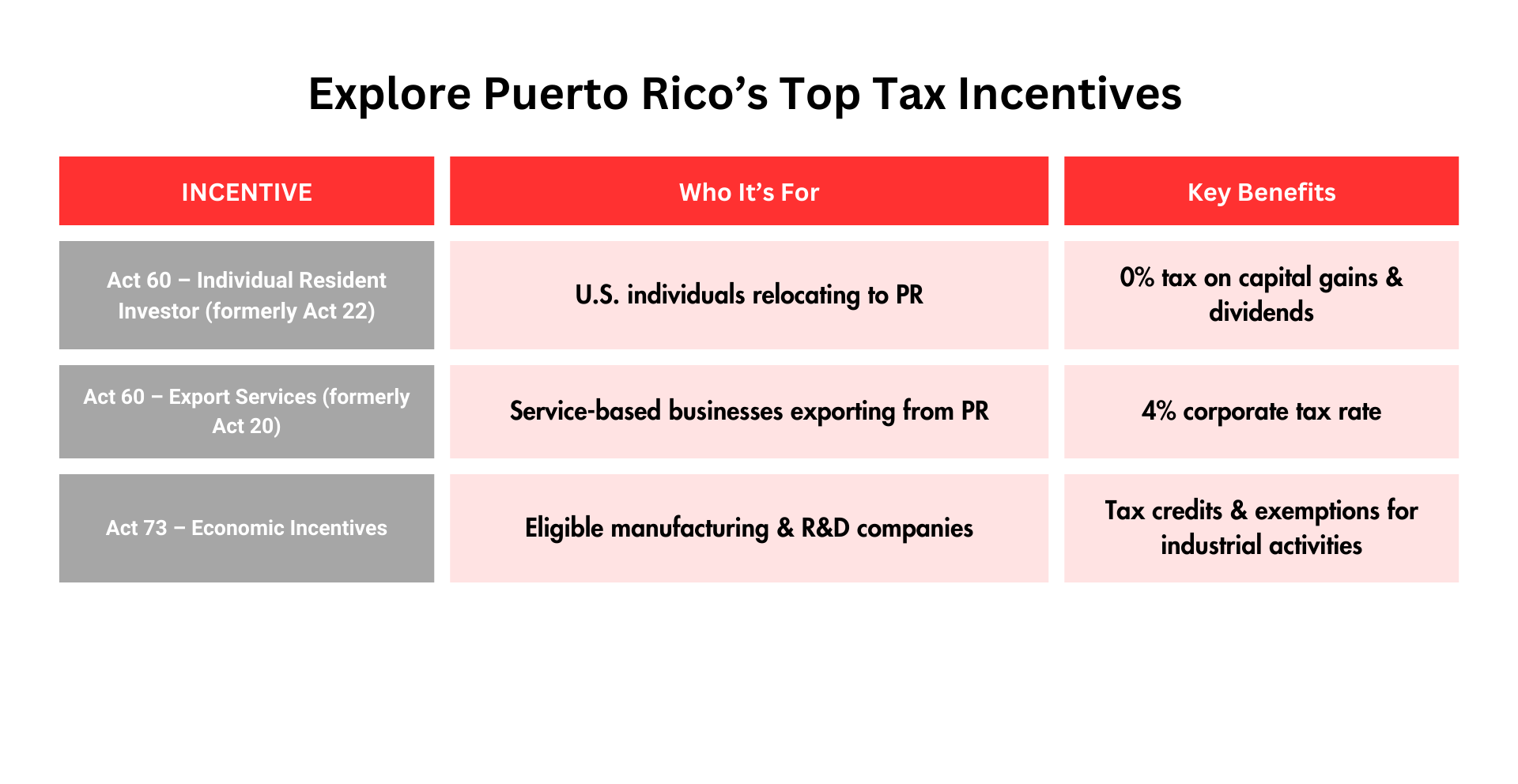

Puerto Rico’s Act 60, Capital Gains, and Corporate Tax Benefits

Introduction

Puerto Rico has increasingly become a top destination for investors, entrepreneurs, and high-net-worth individuals seeking favorable tax treatment. Central to this appeal is Act 60 of 2019, also known as the Puerto Rico Incentives Code, which consolidated and modernized previous tax incentive laws such as Acts 20 and 22. Act 60, along with existing tax structures related to capital gains and corporate income, offers significant opportunities for those willing to meet Puerto Rico’s residency and compliance requirements. This report outlines the rules, requirements, and benefits of Act 60, a detailed examination of capital gains tax treatment, and an overview of corporate tax benefits currently available under Puerto Rico’s tax laws.

Puerto Rico Act 60 – Rules, Requirements, and Benefits

Background

Before Act 60, Puerto Rico offered various separate incentive programs through multiple laws (most notably Act 20 (Export Services Act) and Act 22 (Individual Investors Act)). Act 60 was passed to consolidate, streamline, and modernize these programs to attract new residents, entrepreneurs, and investors to stimulate the island's economy. Act 60 became effective on January 1, 2020.

Main Components of Act 60

-

✔️

Export Services (formerly Act 20)

- Eligibility: Puerto Rican entities providing eligible services to clients outside Puerto Rico.

- Tax Benefit:

- Flat 4% corporate income tax rate on qualifying income.

- 100% tax exemption on distributions from earnings and profits related to export services.

- Eligible Services Include: Consulting, Legal, Accounting, Tax services, Advertising, Investment banking, Asset management, Software development, Research and development, Engineering and architectural services.

-

✔️

Individual Resident Investor Incentive (formerly Act 22)

- Eligibility: New Puerto Rico bona fide residents (not residents within the past 10 years).

- Tax Benefit:

- 100% tax exemption on Puerto Rico-sourced capital gains accrued after becoming a resident.

- Partial exemption for pre-residency capital gains depending on appreciation timelines.

-

✔️

Other Key Incentive Areas

- Opportunity zones

- Renewable energy projects

- Tourism development

- Manufacturing

- Film and creative industries

Requirements for Act 60 Applicants

- Residency: Physical Presence Test, Tax Home Test, Closer Connection Test.

- Annual Filing: Form 8898 with IRS, DDEC filings.

- Compliance Fees: $300 government filing fee, $10,000 annual donation to nonprofits.

- Minimum Purchase Requirement: Real estate purchase within two years.

Benefits of Act 60

- Tax savings on investment income, dividends, and interest.

- Zero tax on Puerto Rico-sourced capital gains.

- Extremely low corporate tax for qualifying businesses.

- Potential estate planning advantages under Puerto Rico law.

- Lifestyle benefits — warm climate, U.S. territory, U.S. dollar, no passport needed.

Capital Gains Tax Benefits under Puerto Rico Law

Capital gains are treated favorably under Puerto Rico’s unique status as a U.S. territory. Special tax treatment applies for residents who qualify as bona fide Puerto Rican residents.

We at Elite Puerto Rico Reality Can help you find your dream home. CALL US TODAY! Schedule a Trip to Puerto Rico.

We will then show you LUXURY Homes and have you meet with Tax Experts and Law Firms so you can start your Relocation Process!

ALSO . If interested in Florida and USA Mainland instead

Click this Page