Unlock Puerto Rico´s Tax Benefits

The Smart Move for your wealth

Discover the Power of Puerto Rico’s Tax Benefits

Maximize your wealth and enjoy island living with some of the most generous tax incentives in the U.S. territory.

Why Puerto Rico?

Enjoy 0% federal income tax on Puerto Rican-sourced income, 0% long-term capital gains, and 4% corporate tax for service-exporting businesses. All while living in a Caribbean paradise.

Enjoy 0% federal income tax on Puerto Rican-sourced income, 0% long-term capital gains, and 4% corporate tax for service-exporting businesses. All while living in a Caribbean paradise.

Top Tax Advantages You Can’t Ignore

- Act 22: 0% tax on long-term capital gains after residency

- Act 20: 4% corporate tax rate for service exports

- Act 60: Combines the best of Acts 20 & 22 + more

- No federal income tax for Puerto Rico-sourced income

- Tax-free dividends & interest (from Puerto Rico sources)

- 3% tax rate for qualifying manufacturers under Act 60

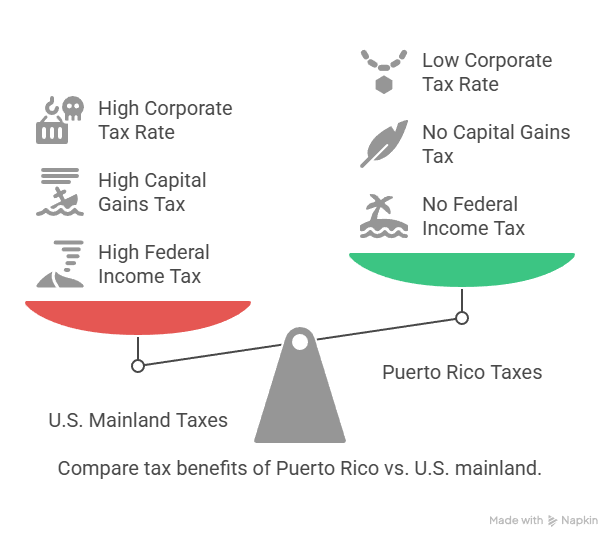

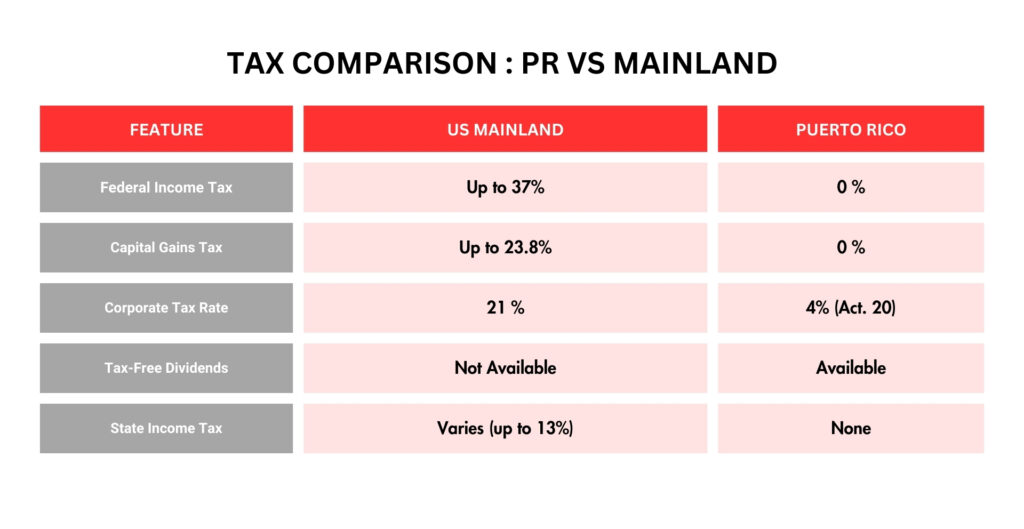

Comparison: Puerto Rico vs. Mainland U.S.

| Feature | U.S. Mainland | Puerto Rico |

|---|---|---|

| Federal Income Tax | Up to 37% | 0% (on PR income) |

| Capital Gains Tax | Up to 23.8% | 0% (for residents) |

| Corporate Tax | Up to 21% | 4% (Act 20) |

| Dividends & Interest | Taxed | Tax-Free (PR source) |

| State Income Tax | Up to 13% | None (for PR income) |

How to Qualify

- Spend at least 183 days/year in Puerto Rico

- Establish Puerto Rico as your primary tax home

- Sever tax ties with your previous U.S. state

Live Where Others Vacation

Beyond tax benefits, Puerto Rico offers:

- Tropical weather all year

- Low cost of living

- World-class beaches and cuisine

- No immigration hassle for U.S. citizens

Ready to Secure Your Tax Advantage?

Let us help you move to Puerto Rico and maximize your wealth while enjoying island life.

Contact Us Today

Book Appointment